The IRS released a slew of early tax season 2024 stats last week, calling it “a strong start to filing season 2024, with all systems running well.”

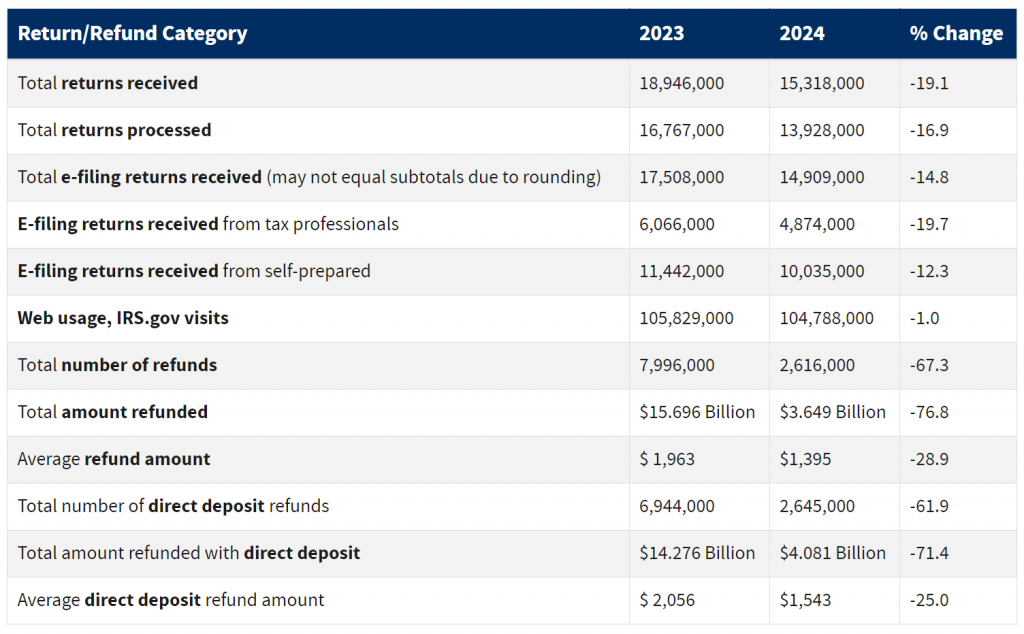

The tax agency seems pleased with how everything is going thus far, despite a 19% decrease in total returns received, a nearly 17% decrease in total returns processed, and the total number of refunds down 67% as of Feb. 2 compared to Feb. 3 of last year. In addition, the average refund amount is $1,395, down about 29% from this time last year.

But no one at the IRS seems too worried about the discrepancies. Why?

“Because the 2023 filing season began on Jan. 23, the IRS had been receiving returns for 12 days by Feb. 3, 2023; compared to only five days for the 2024 filing season, which opened on Jan. 29,” the IRS said last Friday.

Considering the loss of seven days in this comparison, the IRS said it’s happy where things are at.

Makes sense.

Here are the filing season stats the IRS provided last week, as of Feb. 2:

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs